Alright. So now let's dive a little deeper into the topic of mergers. Right? Mergers are when two separate firms combine into one firm, right? They're merging into one firm. So let's see some of the implications of that. Business mergers, right, result from firms merging into one. So there are two types of mergers. We're going to have horizontal mergers, and this is mergers between firms in the same industry, firms in the same industry. A good example, which actually happened a few years ago, is when AT&T and T-Mobile were trying to merge and they had to lobby to government to say that this wasn't going to reduce competition, right, and that they were actually merging because they were going to be able to supply a better product to the consumers. In the end, the government didn't buy it and didn't allow the merger, right, so they thought that the merger would have reduced competition too much and given them too much market power.

The other type of merger is a vertical merger. This is a merger between firms at different stages of production. A real-world example of this was when eBay bought PayPal. Initially, eBay would have the auction on their website, and then when the auction completed, they'd go to the PayPal website to complete the transaction. Well, eBay just cut out the middleman and bought out PayPal so that they didn't have to pay PayPal for whatever fees they had before. We're going to see that the government is more concerned with these horizontal mergers than vertical mergers. With a horizontal merger, that's one way you're going to see situations where there is less competition in the market.

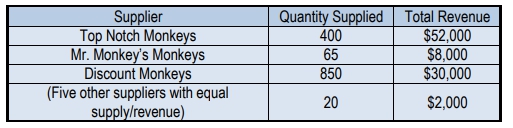

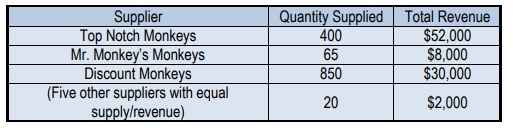

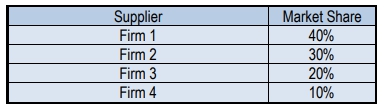

Great, so we're going to discuss the Herfindahl Hirschman Index, alright? This is how the government decides whether a merger is going to be too much for the market, or if it should allow the merger. We're going to use what's called the HHI, which is an index here, to gauge concentration in an industry. So to calculate the HHI, we're going to take the market share of each firm and square it then add them all together. So, the market share of firm A squared, the market share of firm B squared, the market share of firm C. Market share is the share of the total market that the firm has. In a monopoly, the firm's revenue is equal to the total revenue. They're the only firm in the industry so they're going to have a 100% market share. When we do our HHI, we want to have a percentage, something like 20%. We're not going to treat it as 0.2; we're going to use the absolute number of the percent. So if someone had a 20% market share, we would calculate the HHI using 20 squared, not 0.2 squared.

So let's go ahead and first define what our HHI standards are going to be, like what it means once we get our HHIs, and then we'll do some examples of different HHIs in different industries. The first is an HHI below 1500. If the HHI comes out below 1500, we're going to say that it's not concentrated. That's a low HHI. Mergers at that point would be allowed because they don't think that would reduce competition. Next is like middle range, between 1501 and 2500, they're going to say it's moderately concentrated. Now the government might take a little more caution when allowing mergers. And then there are HHIs above 2500. If the market is highly concentrated, this is when the HHI is above 2500, now the government is going to be really cautious about allowing mergers to happen. Okay, let's see some examples of some HHIs. Actually, let's pause right here, and let's do the examples in the next video. Cool, let's start that now.