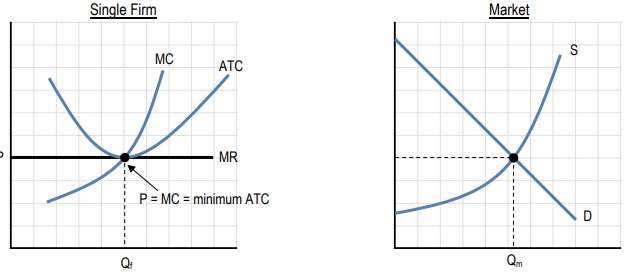

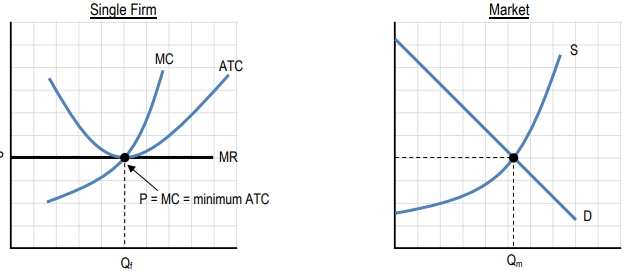

Alright, now let's discuss productive efficiency and allocative efficiency in perfectly competitive markets. So what we're going to see is that in perfect competition, we achieve both productive efficiency and allocative efficiency. Cool? So hooray, we're going to get our efficient quantities here. So let's start with productive efficiency. How is a perfectly competitive market productively efficient? So remember that productive efficiency is producing at the lowest possible cost, okay? Lowest possible cost and the lowest possible cost is the minimum of our ATC, right? The lowest that our average total cost goes, that is the lowest cost, right? So when we talk about productive efficiency, we can think about price equaling average total cost, okay? So that is a condition of our productive efficiency. We're able to produce at the lowest possible cost, okay? And what have we seen? When we've been discussing the long run of perfect competition, we see that the firms are producing at the minimum of ATC. Whoops. My spelling's all over the place. Minimum of the ATC, right? So we are being productively efficient just like we see on this graph, just like we've been talking about in the long run, right? That that price is going to touch right at the minimum of the ATC, right? So we are going to be productively efficient, okay? So they're going to be producing this quantity at this price and that is being produced at the lowest possible cost, so perfect competition forces companies to be as efficient as possible, right? To try and lower their cost as much as possible to make profits. Okay, so we're going to see that we are at the minimum of our ATC when we are in our equilibrium there so we are being productively efficient. Cool?

Let's go on down here to Allocative Efficiency. So remember Allocative Efficiency has to do with consumer preferences, right? Production represents consumer preferences. Okay? So what this means when we start thinking in terms of economic terms, this really means that we're producing up to the point where the marginal benefit equals the marginal cost, right? And when I talk about marginal benefit, we're not talking about the marginal benefit to the producers anymore, right? We're talking about the marginal benefit to the consumers, right, so that marginal benefit to the consumers is going to equal the marginal cost to the producers, right? So only when these are equal are we reaching allocative efficiency, so that's what's going to go in here. Marginal benefit equals marginal cost, that's kind of our condition for allocative efficiency. So let's go into this box here where I'll discuss how we reach allocative efficiency. So first let's start with the idea of the marginal benefit to consumers. So the price of the good represents the last unit sold, right? The marginal benefit of the last unit sold, right? If you think about it, we're selling units to all these people who have a higher willingness to pay, right? We have that downward sloping demand curve. I guess I'll draw it in here just to reiterate. So we've got this downward sloping demand curve, right, And then so that's demand and we've got our supply going up, right? If this is our price right here, well there was somebody way up here who was willing to pay way more than that price, right? This is our equilibrium price but there's all these people on the way down that are willing to pay more than that price until we get to that last person. That last person is willing to pay exactly the price on the market, right? So that's the marginal benefit to the last person, right? When we think of them making a purchase, they're purchasing it because that's the benefit that they get, right? So that last person's benefit is going to be the value of the good, right at the price. So that last unit, the marginal benefit equals the price just like we see here. And now let's think of the other side, the marginal cost side. So in perfect competition, as we've been seeing, the firms are producing where marginal revenue equals marginal cost, right? Our marginal revenue equals our marginal cost, that's the profit maximizing point and we've been doing that all throughout these lessons, right? Marginal revenue equals marginal cost to the firm and well, what did we see in perfect competition? The firm, right let me draw another little graph over here. The firm had the price on the market that they had to sell at, right? This was the price on the market and that was the demand curve that they face, right? Because they can you know let me get out of the way, they can produce any amount and it'll be sold at that price and then there's going to be their marginal cost curve, Right? They're going to have some sort of marginal cost curve here. Whatever it might look like, and this is their price. So right here is the price equals the average revenue equals the marginal revenue to the firm, right? And they're going to produce right there where the price equals marginal cost, right? So the price equals marginal cost, the price equals marginal benefit, well guess what? We can equate the 2 since the firms are producing to the point where the marginal benefit to consumers equals the marginal cost to producers and that's this last one here, right? The price equals marginal benefit, the price equals marginal cost, so there we go we reach productive efficiency, they both equal each other. Marginal benefit to the consumer is equal to the marginal cost to the producer. So there we go, we've reached productive efficiency and allocative efficiency in perfect competition. Unfortunately, our other market structures are not going to achieve productive nor allocative efficiency, okay? So this is a very specific case for perfect competition. Now there is one situation with a monopoly that we will see that an efficiency can be reached, but that's neither here nor there. This is the main key point is that in perfect competition we do get both productive and allocative efficiency. Cool? Alright, so let's go ahead and move on to the next video.