All right. Let's discuss a ratio here, the dividend payout ratio. So the dividend payout ratio is just sometimes called the payout ratio. And guess what? It's going to measure the percentage of earnings that are paid out, distributed to the stockholders as dividends. So this doesn't really fit into the categories that much, but I guess it fits into a profitability ratio because we're dealing with net income here, okay? Notice our dividend payout ratio, we're going to take the cash dividends that are paid to our shareholders and we're going to divide it by net income. So it's going to give us a ratio of how many dollars of dividends for each dollar of net income. You wouldn't expect there to be dividends higher than net income, that generally doesn't happen. You wouldn't have a ratio above 100%. And we usually show this as a percentage, so you'll want to multiply by a 100 to get to percentage mode. But what happens is most companies are going to aim to have a dividend payout that they maintain year to year. So they might say, oh, we're going to pay out 5% of our earnings as dividends every year. So whatever the earnings end up being, 5% of it, that's the dividend you can expect. Okay? So that depends on the company and some companies don't pay dividends at all, right? That's not necessarily a bad thing either. That could just mean that they're focused on reinvesting into the company. So what does a low dividend ratio mean? Well, like I said, it's not necessarily a bad thing. This indicates that they're reinvesting in the company. That's funny. I just said that. And then the other thing is that a decrease in the payouts, well, this could indicate something. Right? If they've had consistent dividend payouts every year, every quarter for a long time, and all of a sudden they're cutting that down. They're like, oh we're going to pay less dividends. You might want to look into that. That could be a red flag of some financial problems, right? Because they're no longer as comfortable paying out those earnings as dividends, maybe they need that money for something else. Maybe they're just trying to reinvest and grow in the business. Whatever it is, you're going to want to look into it. If it's been consistent year to year, and now all of a sudden it's dropping. As an investor, you're going to want to check that out. Cool? Alright. So it's not such a crazy ratio. Let's go ahead and do some practice problems and calculate our dividend payout ratio.

- 1. Introduction to Accounting1h 21m

- 2. Transaction Analysis1h 13m

- 3. Accrual Accounting Concepts2h 38m

- Accrual Accounting vs. Cash Basis Accounting10m

- Revenue Recognition and Expense Recognition24m

- Introduction to Adjusting Journal Entries and Prepaid Expenses36m

- Adjusting Entries: Supplies12m

- Adjusting Entries: Unearned Revenue11m

- Adjusting Entries: Accrued Expenses12m

- Adjusting Entries: Accrued Revenues6m

- Adjusting Entries: Depreciation16m

- Summary of Adjusting Entries7m

- Unadjusted vs Adjusted Trial Balance6m

- Closing Entries10m

- Post-Closing Trial Balance2m

- 4. Merchandising Operations2h 30m

- Service Company vs. Merchandising Company10m

- Net Sales28m

- Cost of Goods Sold - Perpetual Inventory vs. Periodic Inventory9m

- Perpetual Inventory - Purchases10m

- Perpetual Inventory - Freight Costs9m

- Perpetual Inventory - Purchase Discounts11m

- Perpetual Inventory - Purchasing Summary6m

- Periodic Inventory - Purchases14m

- Periodic Inventory - Freight Costs7m

- Periodic Inventory - Purchase Discounts10m

- Periodic Inventory - Purchasing Summary6m

- Single-step Income Statement4m

- Multi-step Income Statement17m

- Comprehensive Income2m

- 5. Inventory1h 55m

- Merchandising Company vs. Manufacturing Company6m

- Physical Inventory Count, Ownership of Goods, and Consigned Goods10m

- Specific Identification7m

- Periodic Inventory - FIFO, LIFO, and Average Cost23m

- Perpetual Inventory - FIFO, LIFO, and Average Cost31m

- Financial Statement Effects of Inventory Costing Methods10m

- Lower of Cost or Market11m

- Inventory Errors14m

- 6. Internal Controls and Reporting Cash1h 16m

- 7. Receivables and Investments3h 8m

- Types of Receivables8m

- Net Accounts Receivable: Direct Write-off Method5m

- Net Accounts Receivable: Allowance for Doubtful Accounts13m

- Net Accounts Receivable: Percentage of Sales Method9m

- Net Accounts Receivable: Aging of Receivables Method11m

- Notes Receivable25m

- Introduction to Investments in Securities13m

- Trading Securities31m

- Available-for-Sale (AFS) Securities26m

- Held-to-Maturity (HTM) Securities17m

- Equity Method25m

- 8. Long Lived Assets5h 1m

- Initial Cost of Long Lived Assets42m

- Basket (Lump-sum) Purchases13m

- Ordinary Repairs vs. Capital Improvements10m

- Depreciation: Straight Line32m

- Depreciation: Declining Balance29m

- Depreciation: Units-of-Activity28m

- Depreciation: Summary of Main Methods8m

- Depreciation for Partial Years13m

- Retirement of Plant Assets (No Proceeds)14m

- Sale of Plant Assets18m

- Change in Estimate: Depreciation21m

- Intangible Assets and Amortization17m

- Natural Resources and Depletion16m

- Asset Impairments16m

- Exchange for Similar Assets16m

- 9. Current Liabilities2h 19m

- 10. Time Value of Money1h 23m

- 11. Long Term Liabilities2h 45m

- 12. Stockholders' Equity2h 15m

- Characteristics of a Corporation17m

- Shares Authorized, Issued, and Outstanding9m

- Issuing Par Value Stock12m

- Issuing No Par Value Stock5m

- Issuing Common Stock for Assets or Services8m

- Retained Earnings14m

- Retained Earnings: Prior Period Adjustments9m

- Preferred Stock11m

- Treasury Stock9m

- Dividends and Dividend Preferences17m

- Stock Dividends10m

- Stock Splits9m

- 13. Statement of Cash Flows2h 24m

- 14. Financial Statement Analysis5h 25m

- Horizontal Analysis14m

- Vertical Analysis23m

- Common-sized Statements5m

- Trend Percentages7m

- Discontinued Operations and Extraordinary Items6m

- Introduction to Ratios8m

- Ratios: Earnings Per Share (EPS)10m

- Ratios: Working Capital and the Current Ratio14m

- Ratios: Quick (Acid Test) Ratio12m

- Ratios: Gross Profit Rate9m

- Ratios: Profit Margin7m

- Ratios: Quality of Earnings Ratio8m

- Ratios: Inventory Turnover10m

- Ratios: Average Days in Inventory9m

- Ratios: Accounts Receivable (AR) Turnover9m

- Ratios: Average Collection Period (Days Sales Outstanding)8m

- Ratios: Return on Assets (ROA)8m

- Ratios: Total Asset Turnover5m

- Ratios: Fixed Asset Turnover5m

- Ratios: Profit Margin x Asset Turnover = Return On Assets9m

- Ratios: Accounts Payable Turnover6m

- Ratios: Days Payable Outstanding (DPO)8m

- Ratios: Times Interest Earned (TIE)7m

- Ratios: Debt to Asset Ratio5m

- Ratios: Debt to Equity Ratio5m

- Ratios: Payout Ratio5m

- Ratios: Dividend Yield Ratio7m

- Ratios: Return on Equity (ROE)10m

- Ratios: DuPont Model for Return on Equity (ROE)20m

- Ratios: Free Cash Flow10m

- Ratios: Price-Earnings Ratio (PE Ratio)7m

- Ratios: Book Value per Share of Common Stock7m

- Ratios: Cash to Monthly Cash Expenses8m

- Ratios: Cash Return on Assets7m

- Ratios: Economic Return from Investing6m

- Ratios: Capital Acquisition Ratio6m

- 15. GAAP vs IFRS56m

- GAAP vs. IFRS: Introduction7m

- GAAP vs. IFRS: Classified Balance Sheet6m

- GAAP vs. IFRS: Recording Differences4m

- GAAP vs. IFRS: Adjusting Entries4m

- GAAP vs. IFRS: Merchandising3m

- GAAP vs. IFRS: Inventory3m

- GAAP vs. IFRS: Fraud, Internal Controls, and Cash3m

- GAAP vs. IFRS: Receivables2m

- GAAP vs. IFRS: Long Lived Assets5m

- GAAP vs. IFRS: Liabilities3m

- GAAP vs. IFRS: Stockholders' Equity3m

- GAAP vs. IFRS: Statement of Cash Flows5m

- GAAP vs. IFRS: Analysis and Income Statement Presentation5m

Ratios: Payout Ratio - Online Tutor, Practice Problems & Exam Prep

Created using AI

Created using AIThe dividend payout ratio measures the percentage of earnings distributed to shareholders as dividends. It is calculated by dividing cash dividends by net income, yielding a ratio that indicates how much is paid out per dollar of net income. A ratio above 100% is uncommon, as it suggests financial issues. Companies often maintain a consistent payout ratio, which can signal stability or potential reinvestment strategies. A sudden decrease in dividends may indicate financial difficulties, prompting further investigation by investors.

Ratios: Payout Ratio

Video transcript

ConsistoCo has a policy to maintain a constant payout ratio from year to year. During the previous fiscal year, net income totaled $1,200,000 and ConsistoCo paid $240,000 in dividends. This year, due to the settlement of a lawsuit, the company had net income of $700,000. What amount of dividends would investors expect ConsistoCo to declare this year?

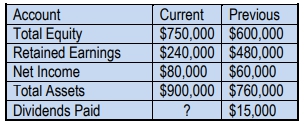

Dive Company maintains a policy to have a consistent payout ratio from year to year. Selected financial information for the company is as follows:

What amount of dividends would the company pay during the current year?

Here’s what students ask on this topic:

What is the dividend payout ratio and how is it calculated?

The dividend payout ratio measures the percentage of a company's earnings distributed to shareholders as dividends. It is calculated using the formula:

This ratio indicates how much of the net income is paid out as dividends. For example, a 30% payout ratio means that 30% of the net income is distributed as dividends, while the remaining 70% is retained by the company for reinvestment or other purposes.

Created using AI

Created using AIWhy might a company have a low dividend payout ratio?

A low dividend payout ratio is not necessarily a bad thing. It often indicates that the company is reinvesting a significant portion of its earnings back into the business to fuel growth, research and development, or other strategic initiatives. This can be a positive sign for long-term investors who are looking for capital appreciation rather than immediate income. Additionally, some companies may choose to retain earnings to build a financial cushion for future uncertainties or opportunities.

Created using AI

Created using AIWhat does a sudden decrease in the dividend payout ratio indicate?

A sudden decrease in the dividend payout ratio can be a red flag for investors. It may indicate that the company is experiencing financial difficulties and needs to conserve cash. Alternatively, it could mean that the company is shifting its strategy to reinvest more earnings into growth opportunities. Investors should investigate the reasons behind the change, looking at the company's financial statements, management discussions, and market conditions to understand the underlying causes.

Created using AI

Created using AICan a company have a dividend payout ratio above 100%?

It is uncommon for a company to have a dividend payout ratio above 100%, as this would mean the company is paying out more in dividends than it earns in net income. Such a situation is usually unsustainable and may indicate financial distress. Companies with a payout ratio above 100% might be using retained earnings or taking on debt to maintain dividend payments, which could be a warning sign for investors about the company's financial health.

Created using AI

Created using AIHow does the dividend payout ratio affect investor perception?

The dividend payout ratio can significantly affect investor perception. A stable or increasing payout ratio is often seen as a sign of financial health and reliability, attracting income-focused investors. Conversely, a decreasing payout ratio might raise concerns about the company's financial stability or future profitability. Investors use this ratio to gauge the sustainability of dividend payments and the company's overall financial strategy.

Created using AI

Created using AI