Hey guys, so I promised you we were going to talk about taxes in this course, and the time is finally upon us. Let's check it out. Alright, so first off, why are there taxes at all, right? Why are there taxes? It's for the government to provide public services, right? The government collects taxes so that they can provide public services like education, right? Public education, fire, police, all these services, they need money to provide them, and that comes from taxes, right? We're going to see in this chapter that taxes will either be imposed on the buyer or the seller, right? Someone's going to have to pay the tax, and one note about the taxes we're going to talk about is that we're going to be talking about per unit taxes, right? So this is a tax for each unit that is exchanged. So if the buyer is going to be charged, let's say a $1 tax per unit, that means if you bought one of these, you'd pay the price of the unit and you'd pay an additional $1 in tax. If you were to buy 2, you'd pay the price of the unit twice, but you pay $2 in tax. Right? 1 for each unit, so it's a per unit tax, okay? So let's talk about what the tax is going to do to the curves.

So when we see the tax imposed on a buyer or a seller, it's going to shift that curve by the amount of the tax, but do you think it's going to shift the curve to the left or to the right? So the idea here is it's going to shift to the left, right? When we talked about shifting left or right, we were talking about it being a good thing or a bad thing, right? This sounds like a bad thing. It's higher prices, right? It's going to shift the curve to the left and it's going to shift it by the amount of the tax, okay? We're going to see this in a second once we get down to these graphs. I was very particular in setting these up so that you could see that we're shifting by the amount of the tax.

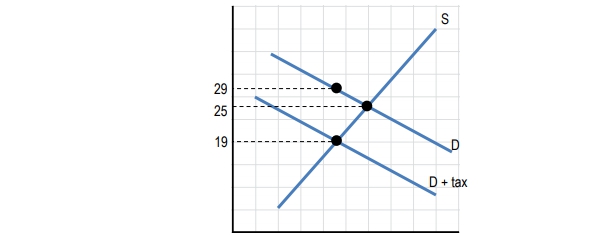

Okay, so now for the first time, we're actually going to see a difference in the prices where the price that the consumer pays is going to be different from the amount the supplier receives, right? And that's because of the tax. So if the consumer is the one paying the tax, they're going to pay the amount of the good plus the amount of the tax, right? And the supplier is only going to receive the amount of the good without the tax. So there's going to be a difference in the amounts that each one pays or receives. So for the buyer, we're going to use this term pb, the price to the buyer, and to the seller, we're going to use ps, for the price to the seller, okay? And so when we talk about price, let's talk about the quantity too. So this tax when the tax is put into the market, it's going to affect our equilibrium that we're not at the equilibrium we wanted to be, right? It's going to cause an inefficiency in the market, and it's going to force us to exchange a lower quantity. A tax always makes the quantity exchanged less than the equilibrium. If the tax was imposed on the buyers, it doesn't necessarily mean that they're going to bear the full burden of the tax, right? The tax burden actually gets split between the buyer and the seller once the market adjusts. So let's go ahead and see that on the graph and we'll start here with taxes on the buyer.

Okay, so what we have is a situation, right? We've got our price axis and our quantity axis here, and in blue, we have our original situation. We have our supply curve here and our original demand curve which I'll call D1 and S1. Okay? So in our original situation, we were at this market equilibrium right here right of $6 and at that market equilibrium of $6, we were trading at this quantity Q star, right? This equilibrium quantity and the government steps in and says, alright, for every unit you buy of this item, you're going to have to pay a $2 tax. So the tax was put onto the buyers here and just like we said above when you get the party that gets taxed, their curve is going to shift to the left by the amount of the tax and that's exactly what we see here.

Effectively, the tax was $2 right? I'm going to write that I don't know where I'll write it. I'll write it right here up top. Tax equals $2 and over here it's going to be $2 as well once we get to the seller, so I'm just going to write that in. The tax is $2 and look what's happened to our demand curve. So our demand curve shifted to the left, right? We've got our new demand curve here to the left and it's shifted by $2 right? If we look on the price axis, we've got a $2 shift. I did it very specifically because it's $2. All of these are going up by 1, 2, 3, 4, right, and that is a $2 shift. We've got 2 squares in there, right? And that's important because I'm trying to be very specific in our ranges here because I'm making a point eventually. So let's go ahead and see what happens.

So in this case, right, the tax was on the buyer, we shifted demand to the left. I'll write that in this box. The demand went to the left by that $2 tax. So what happens once the demand shifts? We shifted it to the left and we have this new demand curve D2, right? Our second demand curve afterward and sometimes actually you'll see this called D plus tax or if it's on the supplier S plus tax, that happens sometimes, there's just a few different ways to name it. Alright, so we're at this new demand curve, right? So what is our new equilibrium here? So the new demand curve crosses the supply curve right here, right? That's going to be the new equilibrium price of $5.10 and notice we have a lower equilibrium quantity here, right? The quantity.onPause() is lower after the tax. I'll put QT.onPause(). QT quantity with the tax, right? It's this lower amount. Okay? So at this price of $5.10, that's the price that's going to be exchanged and that's the amount that we're going to see the sellers receive. The sellers are going to receive this PS of $5.10, but remember the buyers had to pay a $2 tax, right? And that's exactly what we're seeing here. So the sellers are going to receive that $5.10, and then when the buyer gets a unit, they're going to on top of that $5.10 have to pay $2. So you're going to see this right here, right? The price the buyers pay is actually the $7.10, right? And you'll notice that in this case, it's not like the price went up by $2 to the consumer, right?