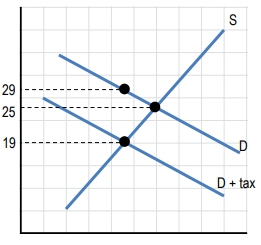

Hey guys, so I promised you we were going to talk about taxes in this course and the time is finally upon us. Let's check it out. Alright, so first off, why are there taxes at all, right? Why are there taxes? And that's for the government to provide public services, right? The government collects taxes so that they can provide public services like education, right? Public education, fire, police, all these services, they need money to provide them and that comes from taxes, right? And we're going to see in this chapter that taxes will either be imposed on the buyer or the seller, right? Someone's going to have to pay the tax and one note about the taxes we're going to talk about is that we're going to be talking about per unit taxes, right? So this is a tax for each unit that is exchanged. So, if the buyer is going to be charged, let's say a $1 tax, per unit, that means if you bought one of these, you'd pay the price of the unit and you'd pay an additional $1 in tax. If you were to buy 2, you'd pay the price of the unit twice, but pay $2 in tax, right? 1 for each unit, so it's a per unit tax, okay? So let's talk about this, what the tax is going to do to the curves. When we see tax imposed on a buyer or a seller, it's going to shift that curve by the amount of the tax but do you think it's going to shift the curve to the left or to the right? The idea here is it’s going to shift to the left, right? When we talked about shifting left or right, we were talking about it being a good thing or a bad thing, right? This sounds like a bad thing. It's higher prices, right? It's going to shift the curve to the left and it's going to shift it by the amount of the tax, okay? We're going to see this in a second once we get down to these graphs. I was very particular in setting these up, so that you could see that we're shifting by the amount of the tax. Okay, so now for the first time, we're actually going to see a difference in the prices where the price that the consumer pays is going to be different than the amount the supplier receives, right? And that's because of the tax. So if the consumer let's say the consumer is the one paying the tax, they're going to pay the amount of the good plus the amount of the tax, right? And the supplier is only going to receive the amount of the good without the tax. So there's going to be a difference in the amounts that each one pays or receives. So for the buyer, we're going to use this term pb for the price to the buyer and to the seller, we're going to use ps for the price to the seller. Okay? And so we talked about price, let's talk about the quantity too. This tax when put into the market is going to affect our equilibrium that we're not at the equilibrium we wanted to be, right. It's going to cause an inefficiency in the market and it's going to force us to exchange a lower quantity. A tax always makes the quantity exchange less than the equilibrium tax was imposed on the buyers, it doesn't necessarily mean that they're going to bear the full burden of the tax, right? The tax burden actually gets split between the buyer and the seller once the market adjusts. So let's go ahead and see that on the graph and we'll start here with taxes on the buyer. Okay, so we've got our price axis and our quantity axis here, and in blue, we have our original situation. We have our supply curve here and our original demand curve which I'll call D1 and S1. Okay? So in our original situation, we were at this market equilibrium here right of $6 and at that market equilibrium of $6, we were trading at this quantity Q star right? This equilibrium quantity and the government steps in and says, alright for every unit you buy of this item, you're going to have to pay a $2 tax. So the tax was put on to the buyers here and just like we said above, when you get the party that gets taxed, their curve is going to shift to the left by the amount of the tax and that's exactly what we see here. Effectively, the tax was $2 right? I'm going to write that I don't know where I'll write it. I'll write it right here up top. Tax equals $2 and over here it's going to be $2 as well once we get to the seller, so I'm just going to write that in. The tax is $2 and look what's happened to our demand curve. So our demand curve shifted to the left, right? We've got our new demand curve here to the left and it's shifted by $2 right? If we look on the price axis, we've got a $2 shift. I did it very specifically because it's $2 All of these are going up by 1, 2, 3, 4, right, and that is a $2 shift. We've got 2 squares in there, right? And that's important because I'm trying to be very specific in our ranges here because I'm making a point eventually. So let's go ahead and see what happens. So in this case, right, the tax was on the buyer, we shifted demand to the left. I'll write that in this box. The demand went to the left by that $2 tax. So what happens once the demand shifts? We shift it to the left and we have this new demand curve D2, right? Our second demand curve afterward and sometimes actually you'll see this called D plus tax or if it's on the supplier S plus tax, that happens sometimes, there's just a few different ways to name it. Alright, so we're at this new demand curve, right? So what is our new equilibrium here? So the new demand curve crosses the supply curve right here, right? That's going to be the new equilibrium price of $5.10 and notice we have a lower equilibrium quantity here, right? The quantity is lower after the tax. I'll put QT. QT quantity with the tax, right? It's this lower amount. Okay? So at this price of $5.10 that's the price that's going to be exchanged and that's the amount that we're going to see the sellers receive. The sellers are going to receive this PS of $5.10, but remember the buyers had to pay a $2 tax, right? And that's exactly what we're seeing here. So the sellers are going to receive that $5.10 and then when the buyer gets a unit, they're going to on top of that $5.10 have to pay $2 So you're going to see this right here, right? The price the buyers pay is actually the $7.10, right? And you'll notice that in this case, it's not like the price went up by $2 to the consumer, right? You're seeing that instead of it going up from $6 to $8, you're seeing that the price actually went down to 5.10 for the suppliers and up to 7.10. So the price didn't increase by the full $2 for the consumer. It was actually split a little bit and now I want to make a point here on the right-hand graph where we're going to see that we actually end up in the same situation regardless of who pays the tax. So in this first situation, the buyer was paying the tax and we ended up at these prices of $7.10, $5.10 When the seller pays the tax of $2 in the same market, we're going to end up in the same place. So let's go ahead and see how that happens. So now let me get out of the way, we're going to do the tax on the seller. So just like before, we're going to have our original situation, our supply, and our demand 1, right? And when we have a tax on the seller, the supply line is the one that's going to shift to the left by 2 units, right? So we're going to supply shifts to the left, and it's going to be by 2, because we have $2 here. So we're going to shift by $2, right, and that's exactly the length that you see here in the shift. Right? This is our S2 or our S plus tax, right, and there's a $2 tax right there. That is the shift and that's why it shifted by that much was because it's $2 okay? So now we've got our new supply curve and our demand curve that hasn't been affected and let's find our new equilibrium. Well just to note, right, our old equilibrium was the same in this case, right? We still had $6 equilibrium and now with the tax, where is our equilibrium? So this time the supply curve shift and our equilibrium is up here at, $7.10, right? But notice we still have a lower quantity, right? The quantity exchange is going to be lower because of the tax, so the quantity with the tax is painted some amount lower than the original equilibrium, but now what's happened? So in this case, at this equilibrium, this is the amount $7.10 again, right? That's the amount that the buyers are going to pay, right? They're going to pay that $7.10 to the seller and then the seller with that $7.10 is going to take $2 and pay it to the government and be left with $5.10 right? So it doesn't matter who pays the tax, we ended up in the same situation, right? Here's the price to the buyers, the price to the sellers is $5.10 and we ended up in the same situation, right? So it was just in one case, in the first case the buyer paid the tax, right? So the supplier the supplier instantly received the $5.10 and then the buyer went off and paid the $2 to the government, right? And in the second case, the buyer just went ahead and paid the whole $7.10 to the seller and the seller took from that money $2 and sent it to the government, right? In both cases, we ended up in the same situation.

- 0. Basic Principles of Economics1h 5m

- Introduction to Economics3m

- People Are Rational2m

- People Respond to Incentives1m

- Scarcity and Choice2m

- Marginal Analysis9m

- Allocative Efficiency, Productive Efficiency, and Equality7m

- Positive and Normative Analysis7m

- Microeconomics vs. Macroeconomics2m

- Factors of Production5m

- Circular Flow Diagram5m

- Graphing Review10m

- Percentage and Decimal Review4m

- Fractions Review2m

- 1. Reading and Understanding Graphs59m

- 2. Introductory Economic Models1h 10m

- 3. The Market Forces of Supply and Demand2h 26m

- Competitive Markets10m

- The Demand Curve13m

- Shifts in the Demand Curve24m

- Movement Along a Demand Curve5m

- The Supply Curve9m

- Shifts in the Supply Curve22m

- Movement Along a Supply Curve3m

- Market Equilibrium8m

- Using the Supply and Demand Curves to Find Equilibrium3m

- Effects of Surplus3m

- Effects of Shortage2m

- Supply and Demand: Quantitative Analysis40m

- 4. Elasticity2h 16m

- Percentage Change and Price Elasticity of Demand10m

- Elasticity and the Midpoint Method20m

- Price Elasticity of Demand on a Graph11m

- Determinants of Price Elasticity of Demand6m

- Total Revenue Test13m

- Total Revenue Along a Linear Demand Curve14m

- Income Elasticity of Demand23m

- Cross-Price Elasticity of Demand11m

- Price Elasticity of Supply12m

- Price Elasticity of Supply on a Graph3m

- Elasticity Summary9m

- 5. Consumer and Producer Surplus; Price Ceilings and Floors3h 45m

- Consumer Surplus and Willingness to Pay38m

- Producer Surplus and Willingness to Sell26m

- Economic Surplus and Efficiency18m

- Quantitative Analysis of Consumer and Producer Surplus at Equilibrium28m

- Price Ceilings, Price Floors, and Black Markets38m

- Quantitative Analysis of Price Ceilings and Price Floors: Finding Points20m

- Quantitative Analysis of Price Ceilings and Price Floors: Finding Areas54m

- 6. Introduction to Taxes and Subsidies1h 46m

- 7. Externalities1h 12m

- 8. The Types of Goods1h 13m

- 9. International Trade1h 16m

- 10. The Costs of Production2h 35m

- 11. Perfect Competition2h 23m

- Introduction to the Four Market Models2m

- Characteristics of Perfect Competition6m

- Revenue in Perfect Competition14m

- Perfect Competition Profit on the Graph20m

- Short Run Shutdown Decision33m

- Long Run Entry and Exit Decision18m

- Individual Supply Curve in the Short Run and Long Run6m

- Market Supply Curve in the Short Run and Long Run9m

- Long Run Equilibrium12m

- Perfect Competition and Efficiency15m

- Four Market Model Summary: Perfect Competition5m

- 12. Monopoly2h 13m

- Characteristics of Monopoly21m

- Monopoly Revenue12m

- Monopoly Profit on the Graph16m

- Monopoly Efficiency and Deadweight Loss20m

- Price Discrimination22m

- Antitrust Laws and Government Regulation of Monopolies11m

- Mergers and the Herfindahl-Hirschman Index (HHI)17m

- Four Firm Concentration Ratio6m

- Four Market Model Summary: Monopoly4m

- 13. Monopolistic Competition1h 9m

- 14. Oligopoly1h 26m

- 15. Markets for the Factors of Production1h 33m

- The Production Function and Marginal Revenue Product16m

- Demand for Labor in Perfect Competition7m

- Shifts in Labor Demand13m

- Supply of Labor in Perfect Competition7m

- Shifts in Labor Supply5m

- Differences in Wages6m

- Discrimination6m

- Other Factors of Production: Land and Capital5m

- Unions6m

- Monopsony11m

- Bilateral Monopoly5m

- 16. Income Inequality and Poverty35m

- 17. Asymmetric Information, Voting, and Public Choice39m

- 18. Consumer Choice and Behavioral Economics1h 16m

Introducing Taxes and Tax Incidence: Study with Video Lessons, Practice Problems & Examples

Created using AI

Created using AITaxes are essential for funding public services like education and safety. They can be imposed on buyers or sellers, shifting the demand or supply curve leftward, leading to higher prices and lower quantities exchanged. The tax burden is shared between consumers and producers, with tax incidence reflecting how much each party pays. For a $2 tax, consumers might pay $1.10 and producers $0.90, resulting in a 55% and 45% share, respectively. Regardless of who pays the tax, the market equilibrium remains unchanged, demonstrating the concept of economic efficiency.

It's time to collect.

Taxes and Tax Incidence

Video transcript

Tax Incidence

Video transcript

Alright, let's try this example. The following graph depicts the market for a bag of magic beans. If the government imposes a tax of 1 cow on buyers of magic beans, what is the tax incidence on producers of magic beans? Alright, so let's go ahead and look at our graph here real quick. So we've got our price, which is in cows, and our quantity over here, right? And we've got a supply and a demand curve, and then we're going to have a shift in the demand curve because there's a tax on the buyers, right? When the tax is on the buyers, the demand curve is going to shift, and this one's our original demand curve because that's where we have this one price, right? Where we have this cross and this equilibrium going on right here. So right there was our original equilibrium at 2.5, right. So man, this must be some sort of dystopian future Jack and the Beanstalk where first of all there's been a lot of inflation, right? Jack was able to get his bag of magic beans for just one cow and now we're talking about an equilibrium of 2.5 cows, so we're dealing with half cows. Man, this society's gotten pretty weird. So anyways, at this 2.5 price that was our original q-star, right. So let's go ahead and see what happens after this tax is imposed. So the tax is on the buyer and we're going to shift the demand curve just like they have here, and this is going to be d2, right? That was d1, this is d2, or d with the tax, right? So, it's asking us what is the tax incidence on producers, right? The tax incidence is the share of the tax that that party is going to pay. In this case, the producers. So, what is the share of the tax to the producers? We know that the total tax was 1, right? There was 1 cow that was the additional tax here. So it's pretty easy to find it and it's only this area here is representing the tax, right? Between the 1.9 and the 2.9. So how do we gauge what is the amount paid by producers? Well, we know that up here, this 2.9, that's the price the buyers are going to pay, right? They're going to pay this price, PB, and the sellers are going to receive 1.9, right? Because of that 1 cow tax. So if the original equilibrium was at 2.5, right? So sellers were originally receiving 2.5 cows per bag, now they're only receiving 1.9 cows per bag. So what's the difference? 2.5 cows they were originally receiving, minus 1.9, they're paying 0.6 cows of this tax. Right? They're taking 0.6 out of the one, and we can turn this into a percentage pretty quick, right? 0.6 divided by the total tax which was 1 and that's going to give us 0.6, right? So that as a decimal is 60%. So 60% of this one cow tax is being paid by producers in this case and you can see the other 40%, right the 2.9 minus the 2.5, that's being paid by the consumers in this market. Alright, so that's the tax incidence on producers is going to be 60% or 0.6 cows. Alright, let's go ahead to the next video.

If a tax is levied on the sellers of a product, the demand curve:

A tax was levied upon buyers of a good. What is the amount sellers receive after the tax is imposed?

Here’s what students ask on this topic:

Why are taxes imposed on buyers or sellers?

Taxes are imposed on buyers or sellers to generate revenue for the government, which is then used to fund public services such as education, fire and police departments, and infrastructure. By taxing transactions, the government can collect funds necessary to maintain and improve these essential services. The tax can be applied per unit of goods or services exchanged, affecting the market equilibrium by shifting the demand or supply curve to the left, leading to higher prices and lower quantities exchanged.

Created using AI

Created using AIHow does a per unit tax affect the supply and demand curves?

A per unit tax shifts the supply or demand curve to the left by the amount of the tax. If the tax is imposed on buyers, the demand curve shifts leftward, indicating a decrease in quantity demanded at each price level. Conversely, if the tax is imposed on sellers, the supply curve shifts leftward, indicating a decrease in quantity supplied at each price level. This shift results in a new market equilibrium with a higher price for consumers and a lower price received by sellers, along with a reduced quantity exchanged.

Created using AI

Created using AIWhat is tax incidence and how is it shared between consumers and producers?

Tax incidence refers to the distribution of the tax burden between consumers and producers. It indicates how much of the tax each party is responsible for paying. For example, if a $2 tax is imposed, consumers might pay $1.10 and producers $0.90. This means consumers bear 55% of the tax burden, while producers bear 45%. The actual distribution depends on the relative elasticities of supply and demand. Regardless of who is initially taxed, the market adjusts so that the tax burden is shared between both parties.

Created using AI

Created using AIDoes it matter whether the tax is imposed on the buyer or the seller?

No, it does not matter whether the tax is imposed on the buyer or the seller in terms of the final market outcome. The market will adjust so that the tax burden is shared between both parties, and the new equilibrium price and quantity will be the same. The only difference is which curve (demand or supply) shifts. This demonstrates the concept of economic efficiency, where the market reaches the same equilibrium regardless of the initial point of tax imposition.

Created using AI

Created using AIHow do you calculate the tax incidence for consumers and producers?

To calculate the tax incidence, determine the change in price for both consumers and producers before and after the tax. For consumers, subtract the original price from the new price they pay. For producers, subtract the new price they receive from the original price. For example, if the original price is $6, the new price consumers pay is $7.10, and the new price producers receive is $5.10, the tax incidence for consumers is $1.10 and for producers is $0.90. To find the percentage, divide each amount by the total tax and multiply by 100.

Created using AI

Created using AI