Now let's talk about some of the effects on the market when there's a tax imposed. So the first thing we're going to see is that when there's a tax imposed, there's going to be tax revenue, right? The government is going to collect some amount of tax revenue. And we're going to be able to calculate that pretty easily, right? Because we're talking about per unit taxes, right? So for each unit that's sold, there's going to be a tax. So we're going to calculate our tax revenue as the amount of the tax, right, times and this is the per unit tax, right? Per unit tax times the quantity, right? There's going to be one quantity exchanged, which is this quantity that's lower, right? Q and I'll put T, the quantity exchanged at the tax. Alright. Okay. So let's go ahead and see what that looks like on the graph. The tax revenue is pretty easy. You're going to see it's going to be this square that I have highlighted here, right? The tax revenue is going to be represented by that well rectangle, right? So this amount right here this represents the tax and this represents the quantity. Right? Where this is that QT, the quantity with the tax. All right? So that's how we calculate tax revenue. It's going to be the amount of the tax times the quantity that is actually exchanged.

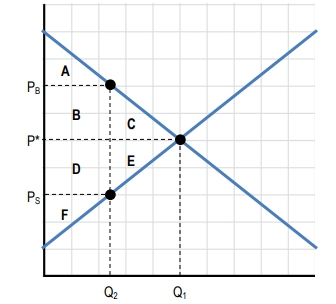

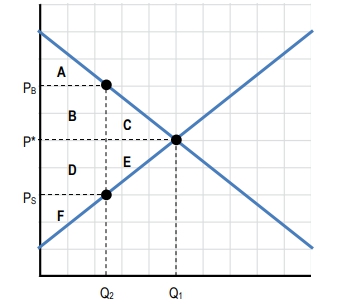

So you'll notice here, right, when we have this tax, we're not in equilibrium, right? The equilibrium was right here and that's where we want to be, but now we have the situation whoops. Woah. Alright, we're back. We have this situation where the price the buyer pays and the price the seller receives is different, right? We're not in equilibrium and there's trades that are not occurring because we're not at that equilibrium price. So what happens when the market is not in equilibrium, right? When the market is not in equilibrium, we lose some of our economic surplus. So remember economic surplus? That was the total of our consumer surplus and our producer surplus. And we're going to see actually another part of surplus in this example. But when we lose economic surplus, we create what's called a deadweight loss, alright? So that loss of surplus is called a deadweight loss, alright? So now we've got a graph here with different sections pointed out and we're going to talk about what happens to those sections in different cases. So first let's talk about without a tax, right? When we're at equilibrium. And then we'll talk about with a tax, what happens.

So let's start without a tax and let's calculate our surpluses. So without a tax, we're going to be at p star, right? And we're going to be trading here at q star. So at this amount, what is our consumer surplus? Remember consumer surplus is going to be everything above the price but below, the demand curve, right? So that's going to be this area right here. At equilibrium, we're going to include all of this area A, B, and C in our Consumer Surplus, right? So we're used to that. That's going to be A plus B plus C. Okay, Now let's do the same thing with producer surplus. So it's going to be everything below the price and above the supply curve. So that's going to be this area right here. Alright. Everything in green, that triangle is going to be our producer surplus. So that's going to be the area of D plus E plus F, right? And now in this case, there was no tax, right? We're just in a free market, no tax, so there's no tax revenue, right? So what's our economic surplus? It's going to be the sum of all of this, right? And remember when we have plus D, plus E, plus F, when we're at equilibrium, we're maximizing that surplus, right? We're getting the most surplus and you can see we're getting everything, right? Everything under in between the curves is being allocated as surplus.

Alright, so before we get back to deadweight loss, which in this case there's none, let's talk about the situation where there is a tax. Okay? So I'm going to erase this so I can reshade these areas with a tax. Okay? So I'm going to put a legend right here. This will be for consumer surplus, producer surplus, deadweight loss. We're going to use this, and we'll use yellow for the tax revenue, okay? So now let's talk about with a tax. Remember with a tax we're seeing different prices for the buyer and the seller and that's what we have here. The price to the buyer and the price of the seller, okay? So let's go ahead and see what happens to consumer surplus. So in this case, the consumer surplus is everything above the price, right? And the price to the consumer is this price, the price of the buyer right there, right? So let me erase this line. So the price up there, that is going to be our consumer surplus. Everything above the price and below the demand curve. So in this case, we've got this little triangle that is just A and that is going to be our consumer surplus A, right? And what has happened to consumer surplus? It was A plus B plus C and now it's just A. So consumer surplus has lost B plus C, right? It's we're subtracting out B plus C, we've lost it because of the tax.

So now we're going to do the same thing, but for the producers. The price is down here, right? This is the price to the producers and the producers are going to get a surplus of just this little area down here, right? Whoops wrong color. Let me get my green. This area, this is the Producer Surplus, right? That triangle. So Producer Surplus is just F, The grade you might get on your exam if you weren't here with Clutch Tutoring. Alright, so what did we lose here? Minus D plus E, right? Producer surplus lost the D plus E section of their surplus. So now let's talk about tax revenue, right? Before we already talked about how we're going to calculate tax revenue, right? This is the amount of the tax right here, right? And, the quantity is right here, right? This is the quantity with the tax. So the tax revenue is going to be that area inside of there. The tax times the revenue or times the quantity is going to give us our tax revenue, which is this rectangle right here of B+D. So you can see that some of the surplus that was from the consumers and some of the surplus from the suppliers has now been transferred over as tax revenue. So you'll see that tax revenue has actually increased by B+D, right? Tax revenue went up in this case. And let's talk about economic surplus real quick. So I know we've been talking about economic surplus is only including consumer surplus and producer surplus, but in this case it's actually going to include the tax revenue as well. Even though the producers and the consumers don't get it themselves, the idea is that the government is going to take this money and benefit from it, right? There's still going to be benefits that come from the tax revenue as opposed to a deadweight loss where there's no benefits at all. So we are going to include the tax revenue in our economic surplus, our total surplus. So we're going to have A plus B plus D plus F. So our economic surplus has lost a little bit here, right? Minus there's no C and there's no E. C and E have been lost from our economic surplus.

Alright, so last but not least, let's talk about the deadweight loss. Without a tax, right, we were saying that we are maximizing our surplus, we're getting everything as surplus and there's no deadweight loss, right? Now what about with a tax? So since there's a tax we're no longer at our efficient quantity and we're losing some trades, right? So those trades are represented by the area CE. Those that's a surplus that we lost because we're not trading all the way up to Q star at a price where we want to trade there, right? So we lost C plus E, the surplus doesn't exist, those trades were not made. So here we go, C, that is our deadweight loss in that situation. So how has it changed? Well it increased by C+ E, right? So our deadweight loss increased by C+ E. You can see right there. Alright, so that is going to be the effects of a tax on the market on all the different surpluses, right? So you're going to see that all these areas have moved and we lost some of our surplus to the deadweight loss because we're not trading at that equilibrium quantity. Alright, so let's go ahead and move on to the next video.