All right, now let's see what happens when we purchase some inventory and have difficulty selling it. We have what's called the rule of conservatism in accounting. This tells us that we're going to be looser when we record losses than when we record gains; we want to be a little more conservative. When something bad happens, we want to be more likely to record something than when something good happens. We want to really make sure that good thing has happened. So, if an asset has lost value, this is a bad thing. If an asset has lost value, we generally will take an expense or loss in the period that it changed value. If we find out that the machine that we have might not last as long as it's supposed to or it's just not worth as much, we might lower the value of that machine in this period. Now, compare that to the opposite. If an asset has gained value, we generally will not take any revenue or any gain until it is sold. So, if we have some land that we purchased and we use it all the time and we find that that land is worth more than we paid for it, well, we're not going to take any of that gain. We're not going to say, "Well, it's worth more, we should say we took the gain." We're not going to take the gain until we sell the land. So, it's going to stay at that price that we paid for it unless we see situations where it goes down. That's the conservatism.

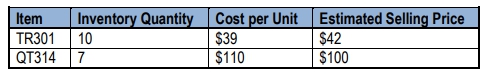

Let's talk about inventory. We have what's called the lower of cost or market rule. We have to mark our inventory, we have to value our inventory at the lower of what we paid for it, the cost, the historical cost of the inventory, and that's what we paid for it or the market. So, when we say lower of cost or market, that's super straightforward. It's either we're going to say inventory is worth cost or inventory is worth market. So, let's define the market. Market is what we call the net realizable value of the inventory or just the current replacement cost. The current replacement cost is the market price. If you had paid $50 per unit for inventory and right now, for whatever reason, it got cheaper to produce, those units are now selling for $30 per unit, that would be the current replacement cost; that current market price. Net realizable value is a little different. Net realizable value, we're going to estimate a selling price, which they're going to have to give you in the question. They're going to have to say we expect to be able to sell these for $50, but then we're going to have some disposal costs. Disposal costs might mean you might have to pay a commission to the salesman if you do sell it. You'll have some sort of disposal cost. It's not just the money coming in; you might have some expenses in selling this product. So, when we do mark down our inventory, which you most likely will when you have a lower of cost or market question, you're probably going to be in a situation where you're lowering inventory. Well, you're going to write a loss from write-down of inventory. A loss so goes up, goes up with a debit because it's a loss which is similar to an expense. So those go up with debits there.

Cool? So let's go ahead and do this example so we can kind of drive this in. OpsoCorp purchased inventory 4 years ago for $84,000. In the current year, OpsoCorp estimated it could sell this inventory for $86,000 while incurring selling expenses of $7,000. In its financial statements, OpsoCorp should report inventory at. So remember, we're either going to record it at cost or market. So let's make 2 columns. Let's say what is our cost and what is our market, and remember, it has to be the lower of cost or market. So cost, it tells us that he purchased it 4 years ago for $84,000. Easy enough. That's the cost of the inventory. Now, the market, in this situation, they didn't tell us any information about the current replacement cost. They didn't say, "Currently, you could buy this inventory for so and so." No. What they told us was information about net realizable value. They told us the estimated selling price is $86,000 while incurring expenses of $7,000. So our net realizable value is going to be $86,000 minus $7,000. That's going to be $79,000. Yep. So, last step, which one's lower? This is lower of cost or market. Well, in this case, the market is lower. So the market is the lower one, so that's what we should value our inventory at. Right now, our inventory says it's worth $84,000, but we haven't sold it. It's still sitting there. It's just sitting on our books at $84,000, and now we re-evaluated that we think it's only worth $79,000 when we sell it. Okay? So we should take that loss now. So the inventory should be marked down to $79,000, and just to drive it in, let me show you what the entry might look like. We would have a journal entry where we would debit loss from write-down of inventory, and I'm going to put WD for write-down of inventory, so that would be our loss and that's the debit in this situation. So how much is the loss? Well, the loss is, we were at $84,000, right? $84,000 is what it's currently valued at, but it should be valued $79,000. So that means the loss is $5,000 in this situation. You can see that? So $84,000 is the historical cost, that's what we paid for it minus the new market price that we just calculated as $79,000, that means we need to write down our inventory by $5,000. Currently, it's on our books for $84,000, but we want it on our books for $79,000. So we're going to debit this loss for $5,000. So that's the debit of this entry, and then we're going to credit inventory to lower the value of inventory with a credit, and there we go, that would be the entry that we make to lower the value of inventory from $84,000 down to $79,000. But the answer here, they were just asking us what should we value inventory, and the answer would be $79,000. Cool? Let's go ahead and move on to the next video.