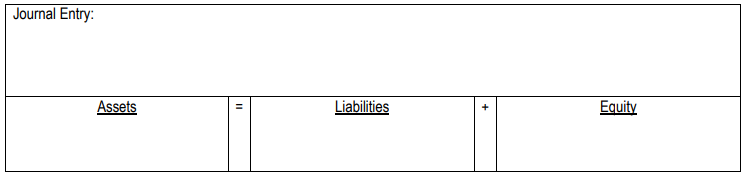

Alright, now let's talk about transactions and the system of debits and credits. So transactions, these are things that are happening all the time, right? Every time something happens in the company, there is a transaction. So you give something up and you receive something in return. Alright? So if you buy some land, right? If you buy land, you give up cash for the land and you get land, right? If you sell something, right, you sell the product, you give up whatever inventory you had and you get revenue for selling that. Right? So let's talk about how this works. So every transaction is going to affect at least 2 accounts. And when I talk about accounts, that was like cash, accounts receivable, accounts payable, the investment account, retained earnings, whatever it is, there's going to be 2 accounts that we're going to affect at least when we do a transaction. Okay? And we're going to use this system of debits and credits. That's what they're called, to account for these transactions. So we're going to have some debits on the transaction and some credits. And what we're going to see is that every transaction must have an equal amount of debits and credits, okay? So when we record a transaction, we're going to record some debits in that transaction and we'll record some credits in that transaction and they have to equal each other. Alright?

So it's still kind of high level. You're going to see some examples down below, but here I want to show you how these accounts are going to work. We're going to see that asset accounts and expense accounts, they're going to increase with debits. Okay? So if you wanted to account for any if you receive some cash and you wanted to account for that, you would debit the cash account for that amount, okay? So that would be how we would increase the asset account, so you can imagine we could decrease an asset or an expense with a credit, right? So if we had to pay cash for something, we would credit the cash account in that amount. Alright, so it's the opposite with liabilities, equity, and revenue accounts. These accounts are increased with credits. Okay? So this isn't so much to memorize, but it is something worth just having it memorized and eventually it's just going to be second nature for you, but for now, it's really important to know that we're going to increase our our assets and our expenses with debits and we're going to increase our liabilities, our equity, and our revenue with credits. Okay? So that's how it's going to work. Let's pause here and I'm going to show you in an example. We're going to do a transaction and see how this works, alright? Let's do that below.