Here are the essential concepts you must grasp in order to answer the question correctly.

Compound Interest Formula

The compound interest formula calculates the amount of money accumulated after n years, including interest on both the initial principal and the interest that has been added to it. The formula is A = P(1 + r/n)^(nt), where A is the amount of money accumulated, P is the principal amount, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years the money is invested.

Recommended video:

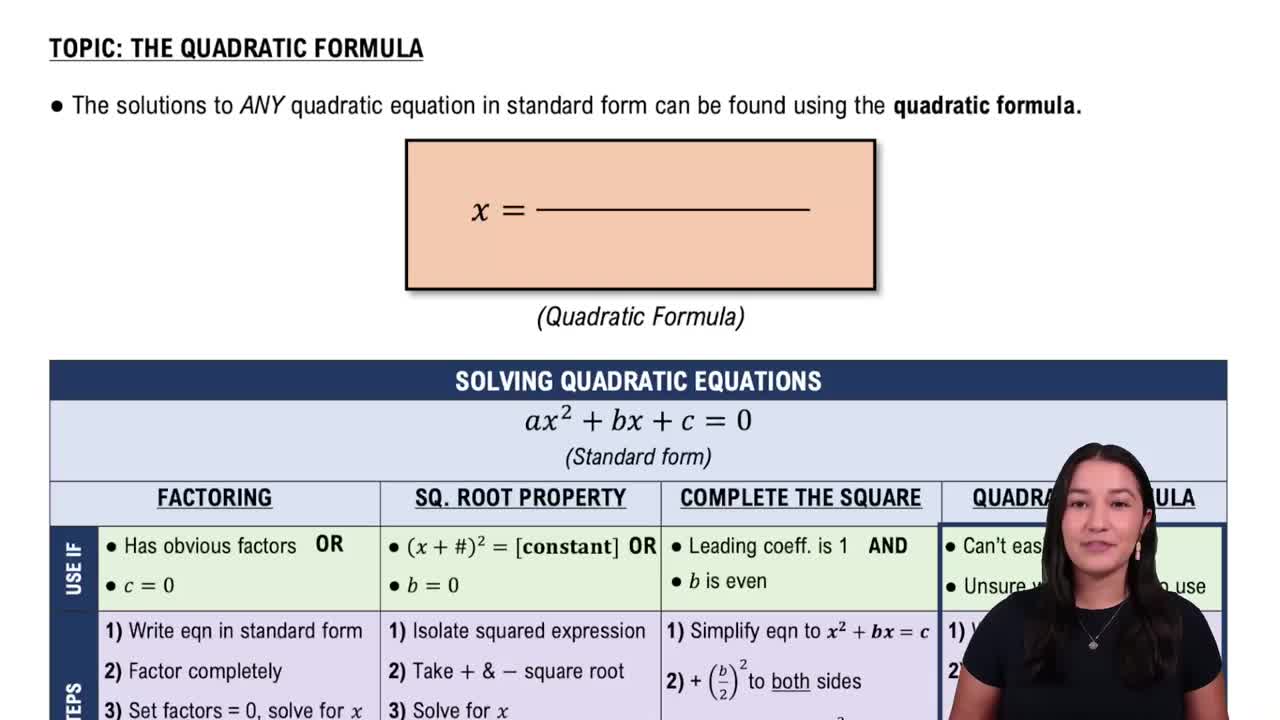

Solving Quadratic Equations Using The Quadratic Formula

Compounding Frequency

Compounding frequency refers to how often interest is calculated and added to the principal balance of an investment. Common compounding frequencies include annually, semiannually, quarterly, and monthly. The more frequently interest is compounded, the more interest will be earned over time, as interest is calculated on previously accumulated interest.

Recommended video:

Effective Annual Rate (EAR)

The Effective Annual Rate (EAR) is a way to compare the annual interest rates of different investments that have different compounding periods. It represents the actual annual return on an investment, taking into account the effects of compounding. The formula for EAR is EAR = (1 + r/n)^(n) - 1, which allows investors to see which investment yields a higher return over the same period.

Recommended video:

Probability of Multiple Independent Events

Verified step by step guidance

Verified step by step guidance