Here are the essential concepts you must grasp in order to answer the question correctly.

Compound Interest Formula

The compound interest formula calculates the amount of money accumulated over time, taking into account the principal amount, interest rate, number of times interest is compounded per year, and the total time in years. The formula A = P (1 + r/n)^(nt) is used for discrete compounding, while A = Pe^(rt) is used for continuous compounding. Understanding how to manipulate these formulas is essential for solving problems related to investment growth.

Recommended video:

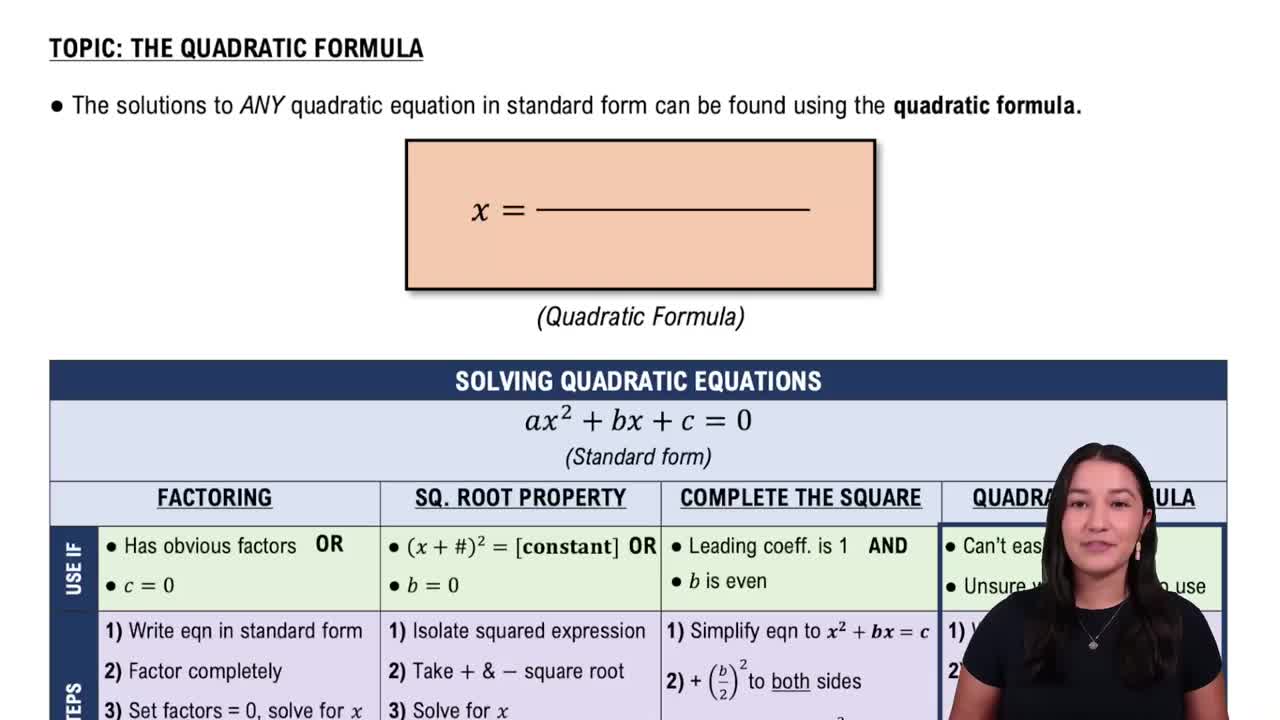

Solving Quadratic Equations Using The Quadratic Formula

Interest Rate

The interest rate is the percentage at which interest is charged or paid on an investment or loan. In the context of compound interest, it determines how quickly the investment grows over time. To find the interest rate in a compound interest problem, one often needs to rearrange the formula to isolate 'r', which can involve logarithmic functions if the equation is complex.

Recommended video:

Time and Compounding Frequency

Time and compounding frequency are critical factors in determining the growth of an investment. The time period (in years) indicates how long the money is invested, while the compounding frequency (e.g., annually, quarterly) affects how often interest is calculated and added to the principal. In this problem, the investment period is 7.25 years with quarterly compounding, which means interest is calculated four times a year, influencing the overall growth of the investment.

Recommended video:

Verified step by step guidance

Verified step by step guidance Verified Solution

Verified Solution

4:46m

4:46m