Now let's see how the government can step in and help provide solutions to externalities. So, we saw these externalities, right? These are costs or benefits that are imposed on people outside the transaction, right? So, we'll see things like pollution, vaccinations, right? Less contagious populations, things like that. So, what we're going to see now, right, we had those graphs where there were these extra costs or extra benefits not included in the market, and what we want to do is we want to internalize these externalities, right? So, this is a phrase that we use and when we say internalize, we want to bring that cost or that benefit from the externality into the market transaction, right? So, we want the people in the transaction to be accounting for this extra cost or benefit, okay? So it's going to force that full cost or benefit into the market transaction, okay? And we're going to see this for public solutions as well as private. Once we get to private solutions in other videos, we're going to be internalizing these externalities, okay? So let's see how the government can step in and do that.

The first type of thing the government can do is these command and control policies. This is where the government just puts its foot down and says you have to do this or you can't do this, right? It just makes a law. This is the way it has to be done. They're going to require or forbid certain behavior, right? So, on the positive side, right, in the idea of a positive externality, we have been talking about education having these external benefits, right? And the market itself isn't going to take account of these external benefits, so the government steps in and says hey, everybody has to get educated, right? You're going to force this grade school education on everybody because it knows that there's going to be this benefit to society by educating these people, right? So that's kind of a command and control, right? Requiring the education or, how about on the other side, right, in this negative externality, right, where there's this dumping of chemicals into a river by a factory or something, the government can just step in and say hey, you're not allowed to do that, you're not allowed to dump chemicals in the river and then they're going to have to figure out some way to safely get rid of the chemicals, right? They're going to take on the cost to safely dispose of the chemicals. Or the government could also require maybe some sort of like filter system be installed that gets rid of the chemicals as well. In either case, right, the company now has to take on the cost of dealing with those chemicals, right? So that's the first way the government can take action, right? They just say this is the way it has to be or the government can, instill these market-based policies, right? So, before the government was command and control. In this case, the government's either going to implement these corrective taxes, so they're going to put in a tax or a subsidy or they're going to have these quantity limits. They're going to set a limit on quantity. Okay? So we're going to talk about both of these. We're going to talk first in this video we'll spend most of our time talking about these corrective taxes and subsidies, okay? So let's go ahead and jump into that and that's going to be most of the graphs here.

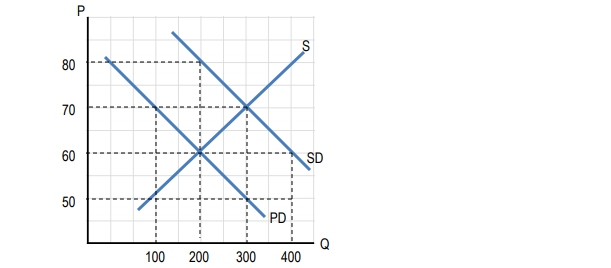

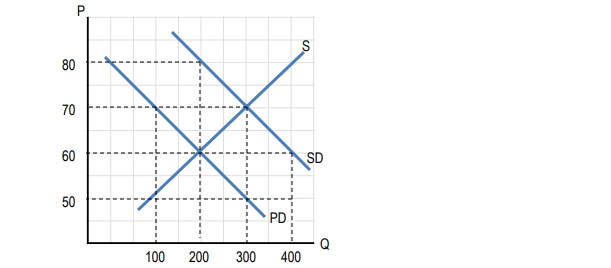

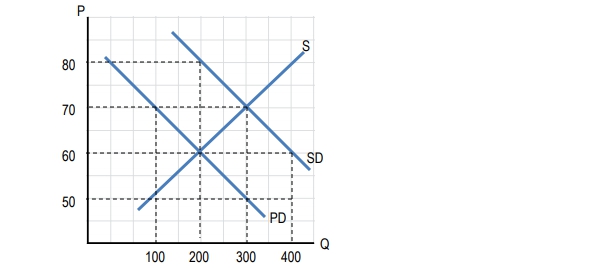

Alright, let's start here with these corrective taxes and what they're also called, is these Pigovian taxes. The reason they have this name is because there was this guy Pigot who won a Nobel Prize for figuring this out. He won a Nobel Prize for figuring out how taxes and subsidies can help us solve problems with externalities. So, his idea, his Nobel Prize-winning idea was to impose a tax or a subsidy equal to the amount of the externality. So, you can imagine if we can quantify this externality, what is the cost of this pollution to society or what is the benefit of this education? We can essentially put in a tax or a subsidy to get us to that correct quantity, right? So what we've seen when we first started talking about these externalities on the graph, we saw that we were not efficient, right? We were at some point where we were overproducing or under-producing because we weren't taking into account the full cost and full benefit to society, right? So first in this negative externality case, right, we had the idea that, if this was our demand curve D1 and this was S1 up here, right, this represented those private costs, right, this was the supply curve that we're used to, right, That it's just the cost the supplier takes into account when he produces the paper. However, when we think of all the costs we include the cost of the pollution, right? It could send us somewhere out here, right? Let's say that was the cost of the pollution to society, that extra cost is added in there now. So that takes us to S2 which was our marginal social cost curve, right? And on that marginal social cost curve all of our costs are included. So we found that our true equilibrium should have been over here, right? This should have been the equilibrium and this should have been the quantity of paper produced over here, Q star where the market was producing here at q I'm going to put M for market, right? The market was producing this higher_quantity. So what can the government do to get us down to that_quantity, right? We were talking about taxes and subsidies. In this case, a tax is what's going to get us to this_quantity. So if you guys remember from when we were talking about taxes, taxes are going to lower our_quantity, right? And that's because the tax puts this difference between the price the buyers pay and the price the sellers receive. So if we were to put a tax in right here equal to the amount of the cost of pollution which by the way the difference between these two curves right here, this length, this is the cost of the pollution. Cost of pollution, right? That's that external cost is that difference between those two curves because that first curve had all our other costs and then we just added one cost, the cost of pollution, and it got us to that other curve. Cool, so this green line I just drew represents an amount of tax, right? So if we were to take SimpleName