Table of contents

- 0. Review of Algebra4h 16m

- 1. Equations & Inequalities3h 18m

- 2. Graphs of Equations43m

- 3. Functions2h 17m

- 4. Polynomial Functions1h 44m

- 5. Rational Functions1h 23m

- 6. Exponential & Logarithmic Functions2h 28m

- 7. Systems of Equations & Matrices4h 6m

- 8. Conic Sections2h 23m

- 9. Sequences, Series, & Induction1h 19m

- 10. Combinatorics & Probability1h 45m

6. Exponential & Logarithmic Functions

Introduction to Exponential Functions

Problem 10

Textbook Question

Textbook QuestionUse the compound interest formulas to solve Exercises 10–11. Suppose that you have $5000 to invest. Which investment yields the greater return over 5 years: 1.5% compounded semiannually or 1.45% compounded monthly?

Verified Solution

Verified SolutionThis video solution was recommended by our tutors as helpful for the problem above

Video duration:

7mPlay a video:

Was this helpful?

Key Concepts

Here are the essential concepts you must grasp in order to answer the question correctly.

Compound Interest Formula

The compound interest formula calculates the amount of money accumulated after n years, including interest on both the initial principal and the interest that has been added to it. The formula is A = P(1 + r/n)^(nt), where A is the amount of money accumulated, P is the principal amount, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years the money is invested.

Recommended video:

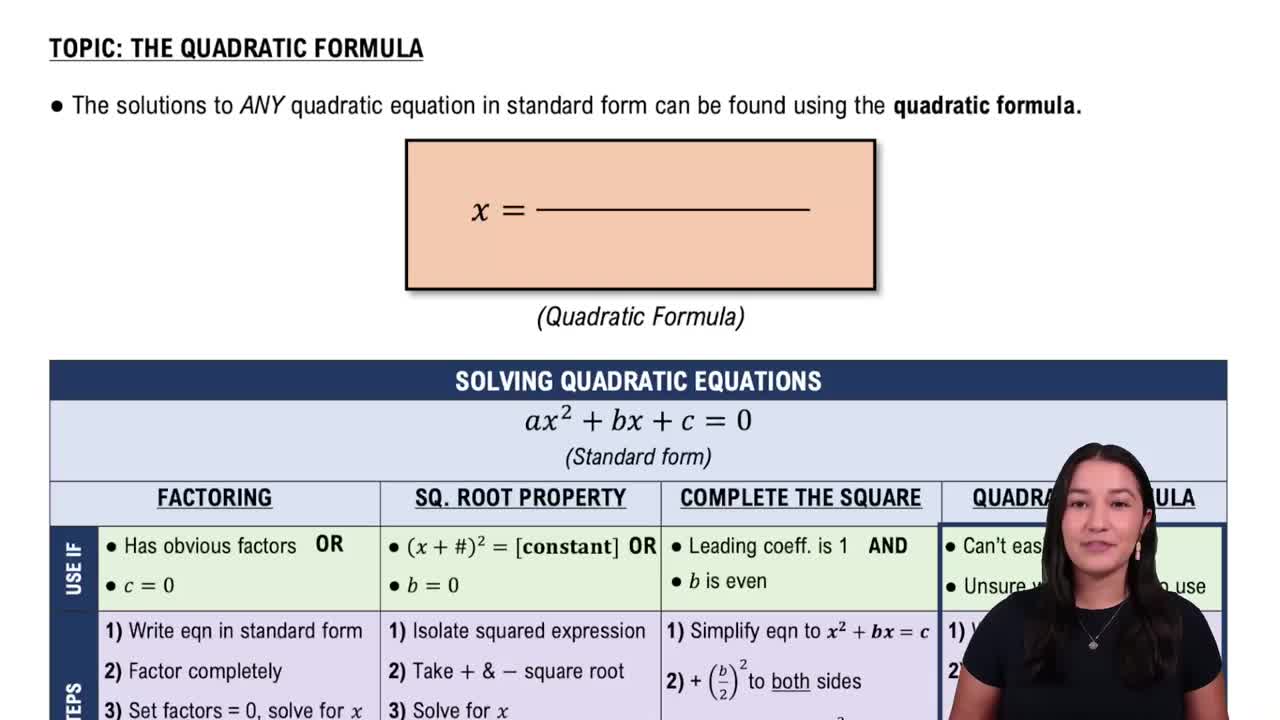

Solving Quadratic Equations Using The Quadratic Formula

Compounding Frequency

Compounding frequency refers to how often interest is calculated and added to the principal balance of an investment. Common compounding frequencies include annually, semiannually, quarterly, and monthly. The more frequently interest is compounded, the more interest will be earned over time, as interest is calculated on previously accumulated interest.

Recommended video:

The Number e

Effective Annual Rate (EAR)

The Effective Annual Rate (EAR) is a way to compare the annual interest rates of different investments that have different compounding periods. It represents the actual annual return on an investment, taking into account the effects of compounding. The formula for EAR is EAR = (1 + r/n)^(n) - 1, which allows investors to see which investment yields a higher return over the same period.

Recommended video:

Probability of Multiple Independent Events

6:13m

6:13mWatch next

Master Exponential Functions with a bite sized video explanation from Callie

Start learningRelated Videos

Related Practice