Here are the essential concepts you must grasp in order to answer the question correctly.

Annual Salary

The annual salary is the total amount of money earned in a year before any deductions. In this case, the job pays $57,900 annually, which includes all forms of compensation, such as bonuses. Understanding the annual salary is crucial for calculating the gross pay per paycheck.

Pay Periods

Pay periods refer to the frequency with which employees are paid. In this scenario, paychecks are issued twice a month, meaning there are 24 pay periods in a year. Knowing the number of pay periods is essential for dividing the total annual salary to find the gross amount per paycheck.

Recommended video:

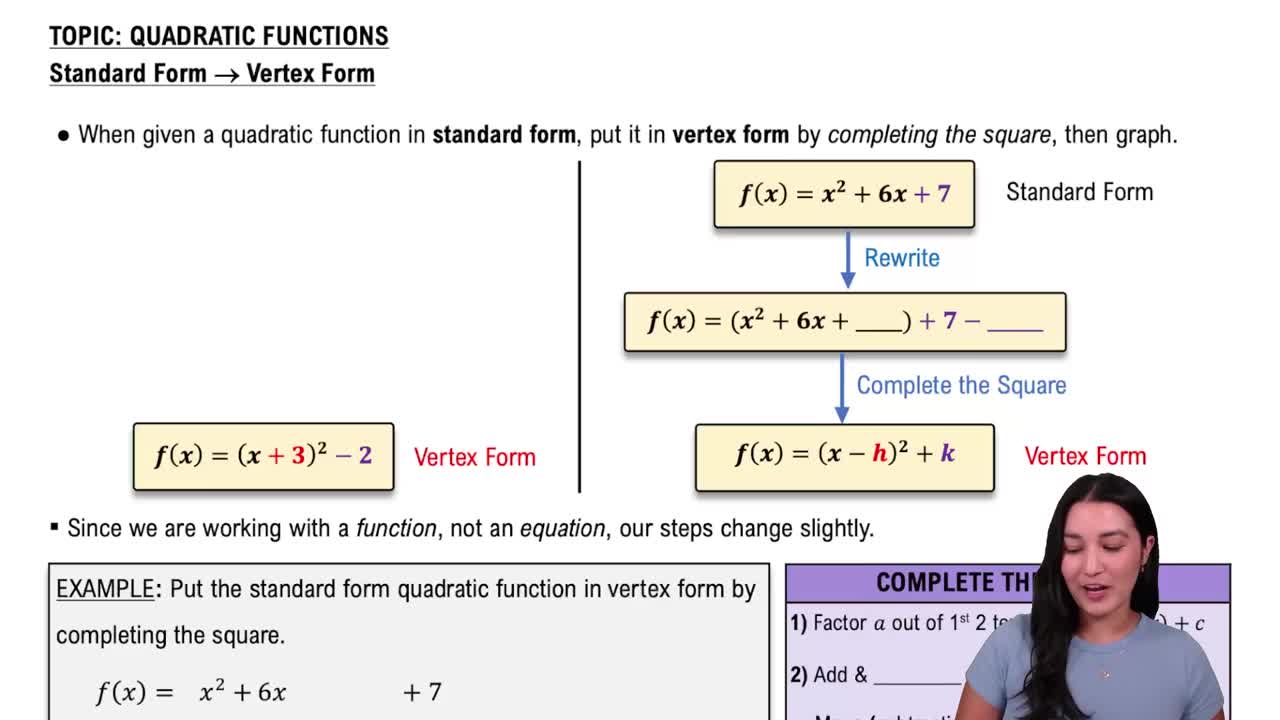

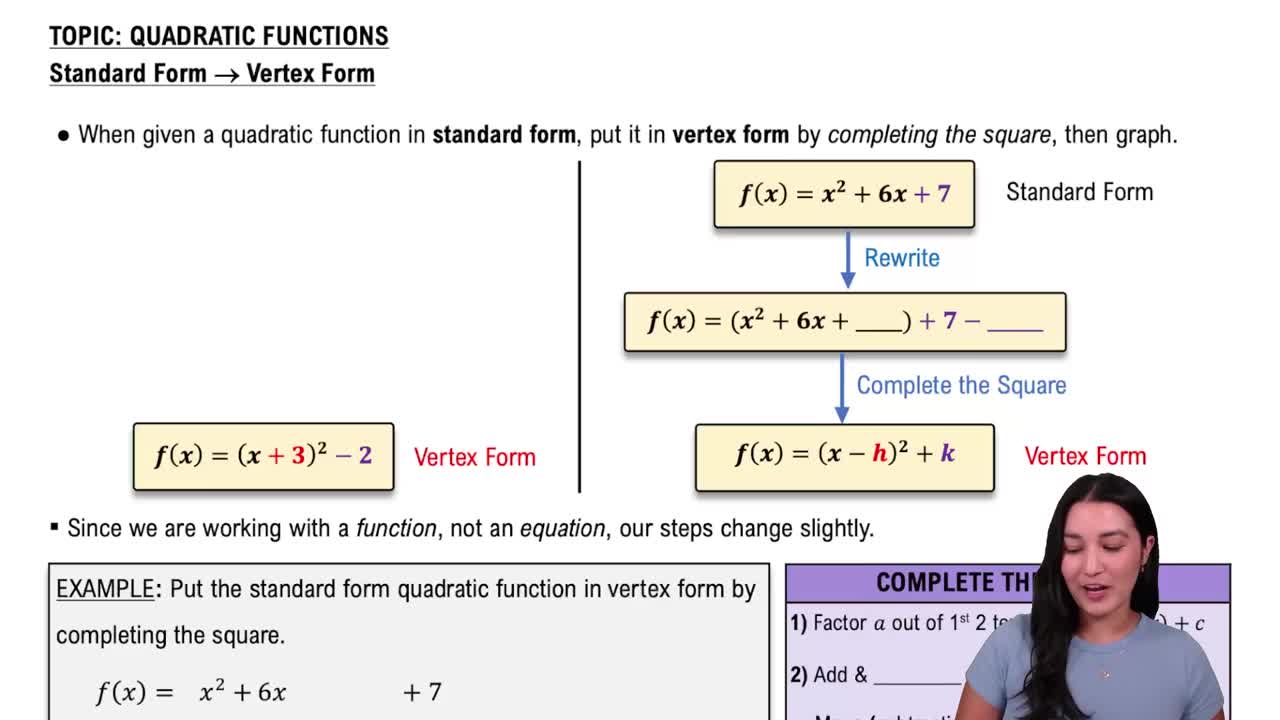

Converting Standard Form to Vertex Form

Gross Pay

Gross pay is the total earnings an employee receives before any deductions such as taxes or retirement contributions. To find the gross amount for each paycheck, the total annual salary, including bonuses, is divided by the number of pay periods. This calculation provides the amount an employee receives in each paycheck.

Recommended video:

Converting Standard Form to Vertex Form

Verified step by step guidance

Verified step by step guidance Verified Solution

Verified Solution

7:48m

7:48m