Table of contents

- 0. Review of Algebra4h 16m

- 1. Equations & Inequalities3h 18m

- 2. Graphs of Equations43m

- 3. Functions2h 17m

- 4. Polynomial Functions1h 44m

- 5. Rational Functions1h 23m

- 6. Exponential & Logarithmic Functions2h 28m

- 7. Systems of Equations & Matrices4h 6m

- 8. Conic Sections2h 23m

- 9. Sequences, Series, & Induction1h 19m

- 10. Combinatorics & Probability1h 45m

1. Equations & Inequalities

Linear Equations

Problem 34b

Textbook Question

Textbook QuestionA job pays an annual salary of $57,900, which includes a holiday bonus of $1500. If paychecks are issued twice a month, what is the gross amount for each paycheck?

Verified Solution

Verified SolutionThis video solution was recommended by our tutors as helpful for the problem above

Video duration:

2mPlay a video:

Was this helpful?

Key Concepts

Here are the essential concepts you must grasp in order to answer the question correctly.

Annual Salary

The annual salary is the total amount of money earned in a year before any deductions. In this case, the job pays $57,900 annually, which includes all forms of compensation, such as bonuses. Understanding the annual salary is crucial for calculating the gross pay per paycheck.

Pay Periods

Pay periods refer to the frequency with which employees are paid. In this scenario, paychecks are issued twice a month, meaning there are 24 pay periods in a year. Knowing the number of pay periods is essential for dividing the total annual salary to find the gross amount per paycheck.

Recommended video:

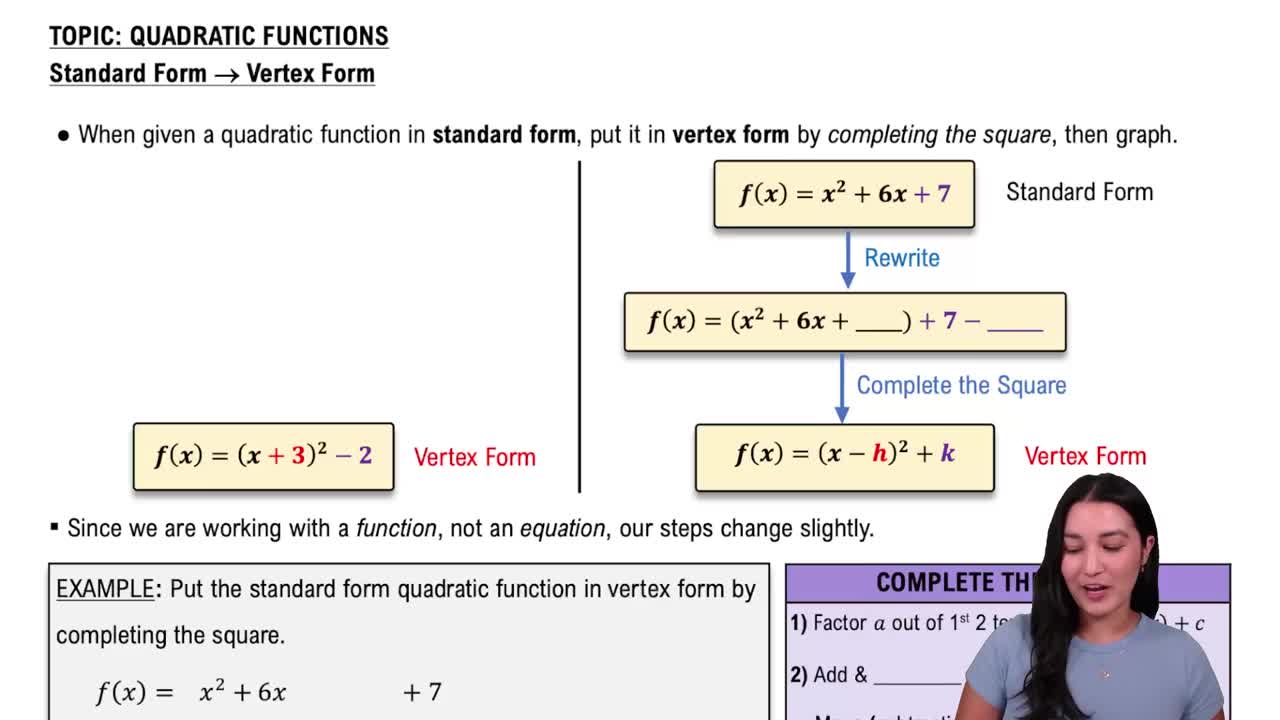

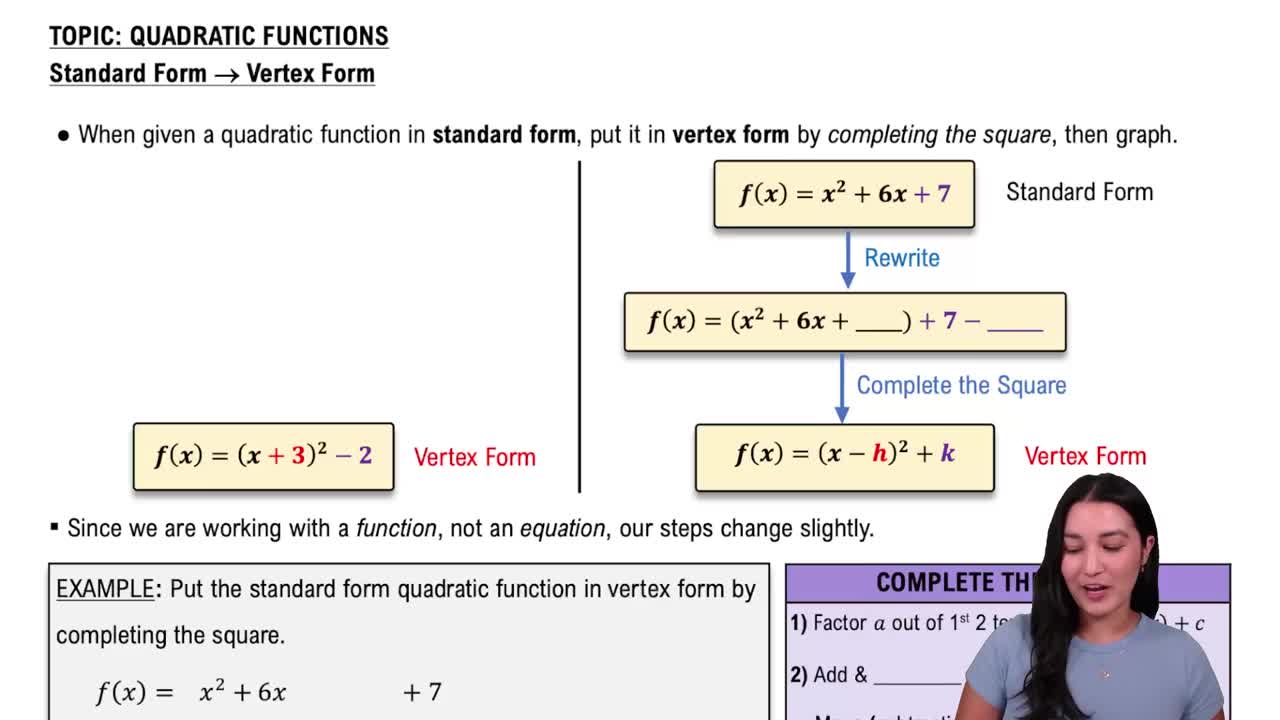

Converting Standard Form to Vertex Form

Gross Pay

Gross pay is the total earnings an employee receives before any deductions such as taxes or retirement contributions. To find the gross amount for each paycheck, the total annual salary, including bonuses, is divided by the number of pay periods. This calculation provides the amount an employee receives in each paycheck.

Recommended video:

Converting Standard Form to Vertex Form

7:48m

7:48mWatch next

Master Introduction to Solving Linear Equtions with a bite sized video explanation from Callie

Start learningRelated Videos

Related Practice