Table of contents

- 0. Functions7h 52m

- Introduction to Functions16m

- Piecewise Functions10m

- Properties of Functions9m

- Common Functions1h 8m

- Transformations5m

- Combining Functions27m

- Exponent rules32m

- Exponential Functions28m

- Logarithmic Functions24m

- Properties of Logarithms34m

- Exponential & Logarithmic Equations35m

- Introduction to Trigonometric Functions38m

- Graphs of Trigonometric Functions44m

- Trigonometric Identities47m

- Inverse Trigonometric Functions48m

- 1. Limits and Continuity2h 2m

- 2. Intro to Derivatives1h 33m

- 3. Techniques of Differentiation3h 18m

- 4. Applications of Derivatives2h 38m

- 5. Graphical Applications of Derivatives6h 2m

- 6. Derivatives of Inverse, Exponential, & Logarithmic Functions2h 37m

- 7. Antiderivatives & Indefinite Integrals1h 26m

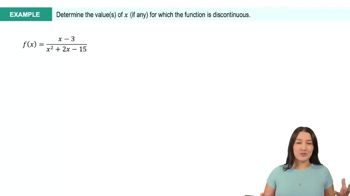

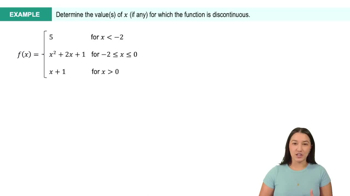

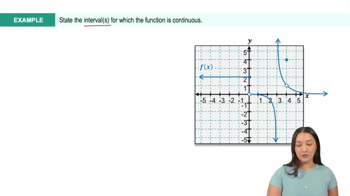

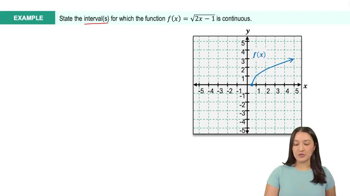

1. Limits and Continuity

Continuity

Problem 2.6.76b

Textbook Question

Textbook QuestionAssume you invest $250 at the end of each year for 10 years at an annual interest rate of . The amount of money in your account after 10 years is given by . Assume your goal is to have $3500 in your account after 10 years.

b. Use a calculator to estimate the interest rate required to reach your financial goal.

Verified Solution

Verified SolutionThis video solution was recommended by our tutors as helpful for the problem above

Video duration:

4mPlay a video:

Was this helpful?

Key Concepts

Here are the essential concepts you must grasp in order to answer the question correctly.

Future Value of an Annuity

The future value of an annuity formula calculates the total amount of money accumulated after making regular investments over time, considering a specific interest rate. In this case, the formula A(r) = 250 * ((1 + r)^{10} - 1) / r represents the future value of investing $250 at the end of each year for 10 years at an interest rate r. Understanding this concept is crucial for determining how much money will be available after the investment period.

Recommended video:

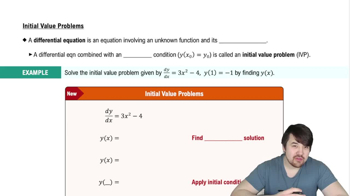

Initial Value Problems

Interest Rate

The interest rate is the percentage at which money grows over time when invested or borrowed. In this problem, the interest rate r is a variable that affects the future value of the annuity. Estimating the interest rate required to reach a specific financial goal, such as $3500, involves solving for r in the future value formula, which can be complex and may require numerical methods or financial calculators.

Recommended video:

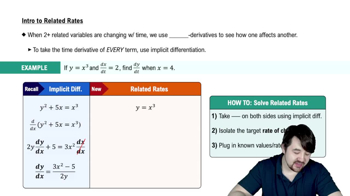

Intro To Related Rates

Numerical Methods

Numerical methods are techniques used to approximate solutions for mathematical problems that cannot be solved analytically. In this context, since the equation for future value involves the variable r in a non-linear way, numerical methods such as the Newton-Raphson method or bisection method can be employed to estimate the interest rate needed to achieve the desired future value. These methods are essential for finding solutions in real-world financial scenarios.

Recommended video:

Finding Limits Numerically and Graphically

Related Videos

Related Practice